Eliminate Debt

Debt is a common issue that many people face in their lives. Whether it’s credit card debt, student loans, or a mortgage, being in debt can be a major source of stress and anxiety. Eliminating debt is essential for achieving financial stability and security. In this blog, we will explore the top 10 reasons why you need to eliminate debt in your life.

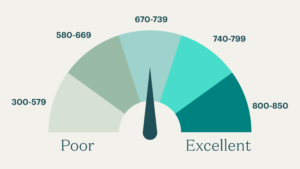

Improve Your Credit Score

Having a high level of debt can negatively impact your credit score and is another great reason why you need to eliminate debt.. A low credit score can make it difficult to get approved for loans or credit cards, and can also result in higher interest rates. By eliminating debt, you can improve your credit score and increase your chances of being approved for loans and credit cards with better terms.

Reduce Stress and Anxiety

Debt can be a major source of stress and anxiety. The constant worry about how you will pay your bills can take a toll on your mental health. By eliminating debt, you can reduce your stress and anxiety levels, and improve your overall quality of life.

Save Money on Interest

When you carry a balance on a credit card or have a loan with a high-interest rate, you are paying more than you need to in interest charges. By eliminating debt, you can save money on interest and use those funds for other things, such as investing or saving for retirement.

Achieve Financial Freedom

Being in debt can feel like a never-ending cycle. By eliminating debt, you can achieve financial freedom and take control of your finances. This can open up new opportunities for you, such as starting a business, pursuing a new career, or traveling.

Increase Your Net Worth

When you are in debt, your net worth is negative. By eliminating debt, you can increase your net worth and build wealth over time. This can provide you with greater financial security and stability.

Improve Your Relationships

Money can be a major source of tension in relationships. By eliminating debt, you can reduce the financial strain on your relationships and improve communication and trust with your partner or family members.

Prepare for Emergencies

When you are in debt, it can be difficult to save for emergencies. By eliminating debt, you can free up funds to create an emergency fund. This can provide you with peace of mind knowing that you are prepared for unexpected expenses.

Invest in Your Future

By eliminating debt, you can free up funds to invest in your future. This can include saving for retirement, investing in a business or real estate, or pursuing additional education or training.

Improve Your Quality of Life

Being in debt can limit your ability to enjoy life to the fullest. By eliminating debt, you can improve your quality of life by reducing financial stress, having more disposable income, and pursuing new opportunities.

Set a Positive Example

By eliminating debt, you can set a positive example for others. This can include your children, friends, and family members. By demonstrating good financial habits, you can inspire others to take control of their finances and achieve their financial goals. Contact us about our new service offered on how to eliminate debt below:

If eliminating debt is of interest to you, use my name, Paul Carrigan, as referring agent and use this link to get started: https://form.jotform.com/eric1848/DFW

If we could get you completely out of debt, everything you owe….house, cars, credit cards, student loans….everything in the next 7-10 years and have a bunch of cash leftover, typically without paying any more than you are already paying… would you want to see the math?

Please watch the video in link below that describes the new service we offer to eliminate debt:

If eliminating debt is of interest to you, use my name, Paul Carrigan, as referring agent and use this link to get started: https://form.jotform.com/eric1848/DFW